HERE'S HOW IT WORKS

Debt COLLECTION & Recovery PROCESS

We collect consciously because we care considerably.

Once an account is turned over to our agency, we handle all future communication with the consumer regarding the account, giving your staff the freedom to perform other functions. When a consumer agrees to pay in full or set up a payment arrangement, we will directly process their credit card, debit card, ACH transaction, mail-in or in-person payment. We will then remit the amount due to your office at the conclusion of the monthly statement cycle. We are here to help alleviate the burden of debt by effectively and efficiently recovering your past-due receivables.

Our unique collection process and philosophy are what set us apart and help us maintain our high success rates. Standardized procedures are put in place for all accounts sent to our agency. Due to legal restrictions and industry regulations on certain types of accounts, the procedure may be slightly different than what is outlined below. Should you have any questions or concerns, we would be delighted to provide you with the exact process that your accounts will undergo once placed in our agency.

-

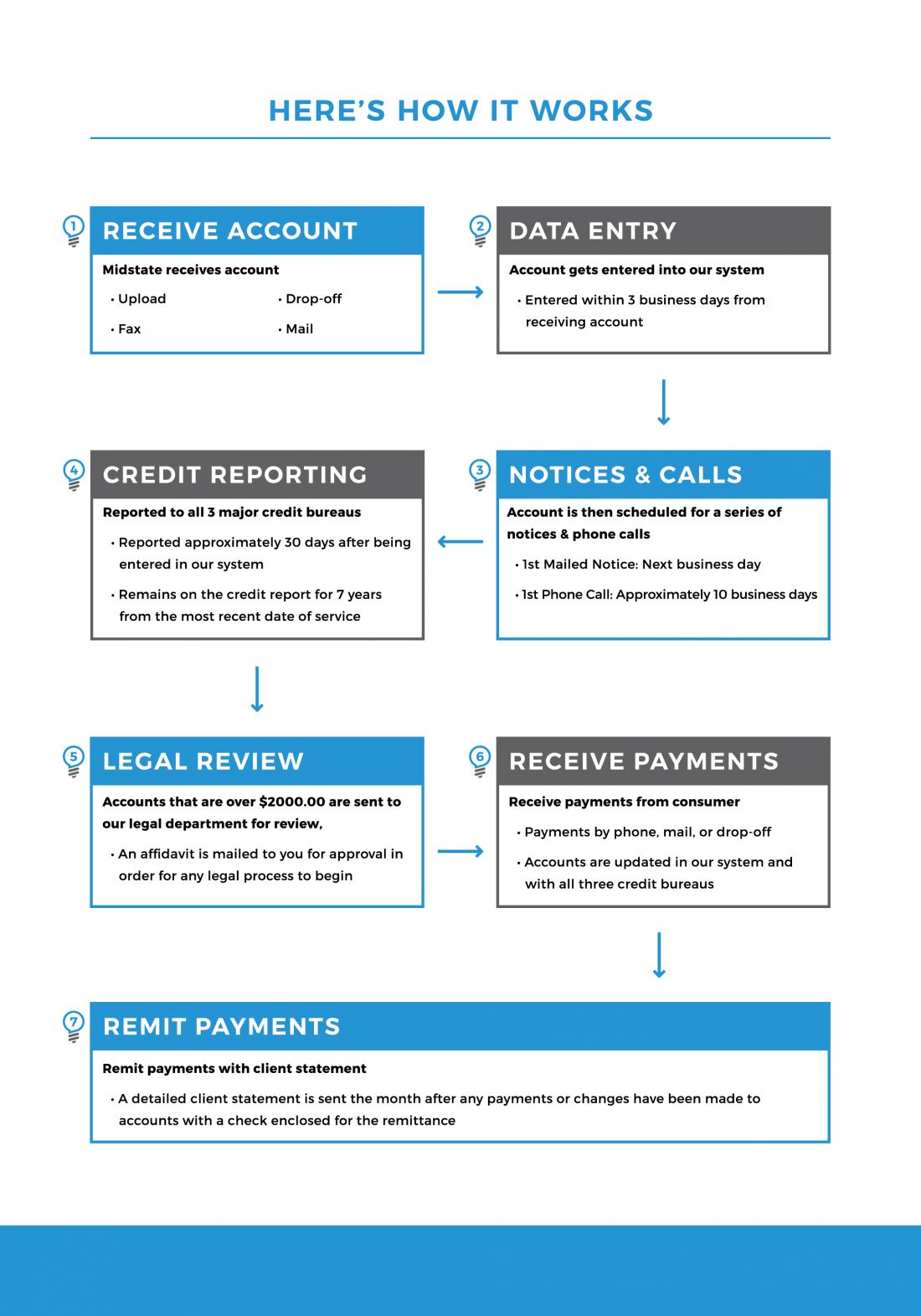

Accounts can be placed with us by uploading to our Client Portal, mail, fax, or in-person drop off.

-

All accounts are entered into our system within 3 business days of receiving them.

-

All accounts are scheduled for a series of phone calls and mailed notices. In accordance with regulations, the first mailed notice to the consumer gives them 30 days to pay the account in full or to dispute it before being reported to the credit bureaus.

-

After 30 days from being placed with us, accounts are reported to all three national credit bureaus. Most other agencies only report to one or two credit bureaus; we're contracted with all three.

-

Individual consumers and their accounts are reviewed often to determine if they are eligible for suit. If we identify a consumer account that meets our list of criteria for litigation, we mail our client an affidavit to sign and return approving or declining litigation efforts.

-

We receive consumer payments by phone, mail, or in-person drop off. When a payment is received, we update our system and all three credit bureaus accordingly.

-

Itemized client statements are sent the month after any payments, adjustments, or court costs have been applied, summarizing all account activity and including a check enclosed with the remittance.